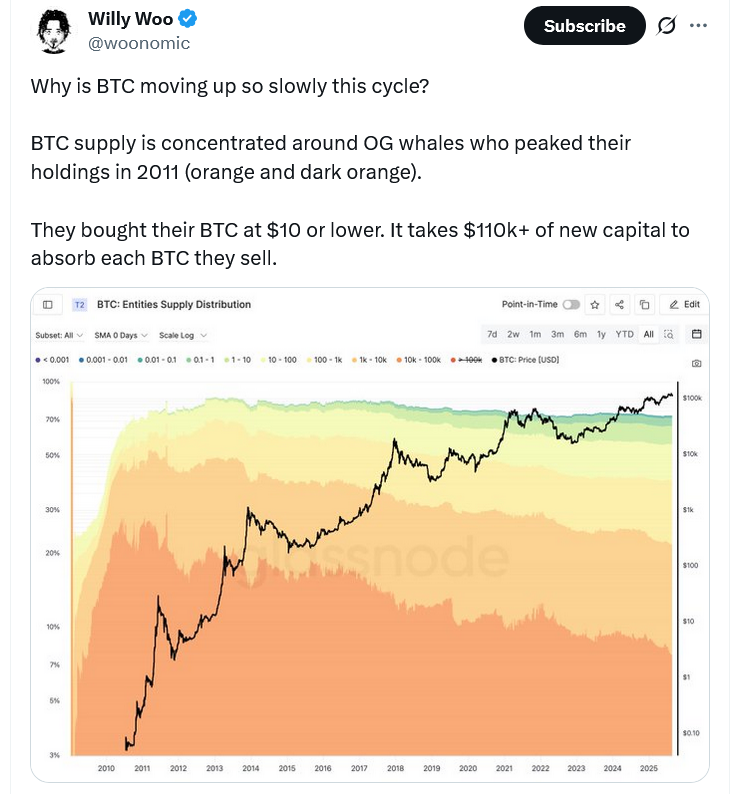

Bitcoin’s oldest whales may be to blame for Bitcoin’s slow price action this cycle, according to Bitcoiner Willy Woo, pointing out that it now takes more than $110,000 of fresh capital to absorb every Bitcoin they sell.

“BTC supply is concentrated around OG whales who peaked their holdings in 2011,” Woo said in an X post on Sunday. “They bought their BTC at $10 or lower.”

“This differential in cost basis, the supply they hold and their rate of selling has profound impacts on how much new capital that needs to come in to lift price,” the OG Bitcoiner said.

Whale blamed for Bitcoin flash crash to $112,000

It comes as the crypto community pointed to a longtime Bitcoin whale’s rotation out of BTC for Ether to explain Bitcoin’s $45 billion market cap plunge on Sunday.

The whale is understood to have rotated more than $2 billion worth of Bitcoin into Ether over the last week, triggering a cascade of sell orders across the market.

The flash crash saw Bitcoin fall almost 2.2% from $114,666 at 7:31 pm UTC to $112,546 in nine minutes before bottoming out at $112,174 at 8:16 pm UTC, CoinGeckodatashows.

ETH also fell a sharp 4% from $4,937 to $4,738 over the same time frame. Both cryptocurrencies recovered about half of the losses incurred from the flash crash.

Many on X have pointed to a crypto whale that began transferring Bitcoin to the decentralized crypto perpetuals platform Hyperliquid on Aug. 16, sending 24,000 BTC ($2.7 billion) across six transfers over the last nine days, Blockchain.com data shows.

Of that, 18,142 BTC worth $2 billion has already been sold, with almost all of it being rotated into 416,598 ETH, according to crypto analyst MLM, who said the whale is behind another set of wallet addresses moving Bitcoin to Hyperliquid for additional ETH purchases.