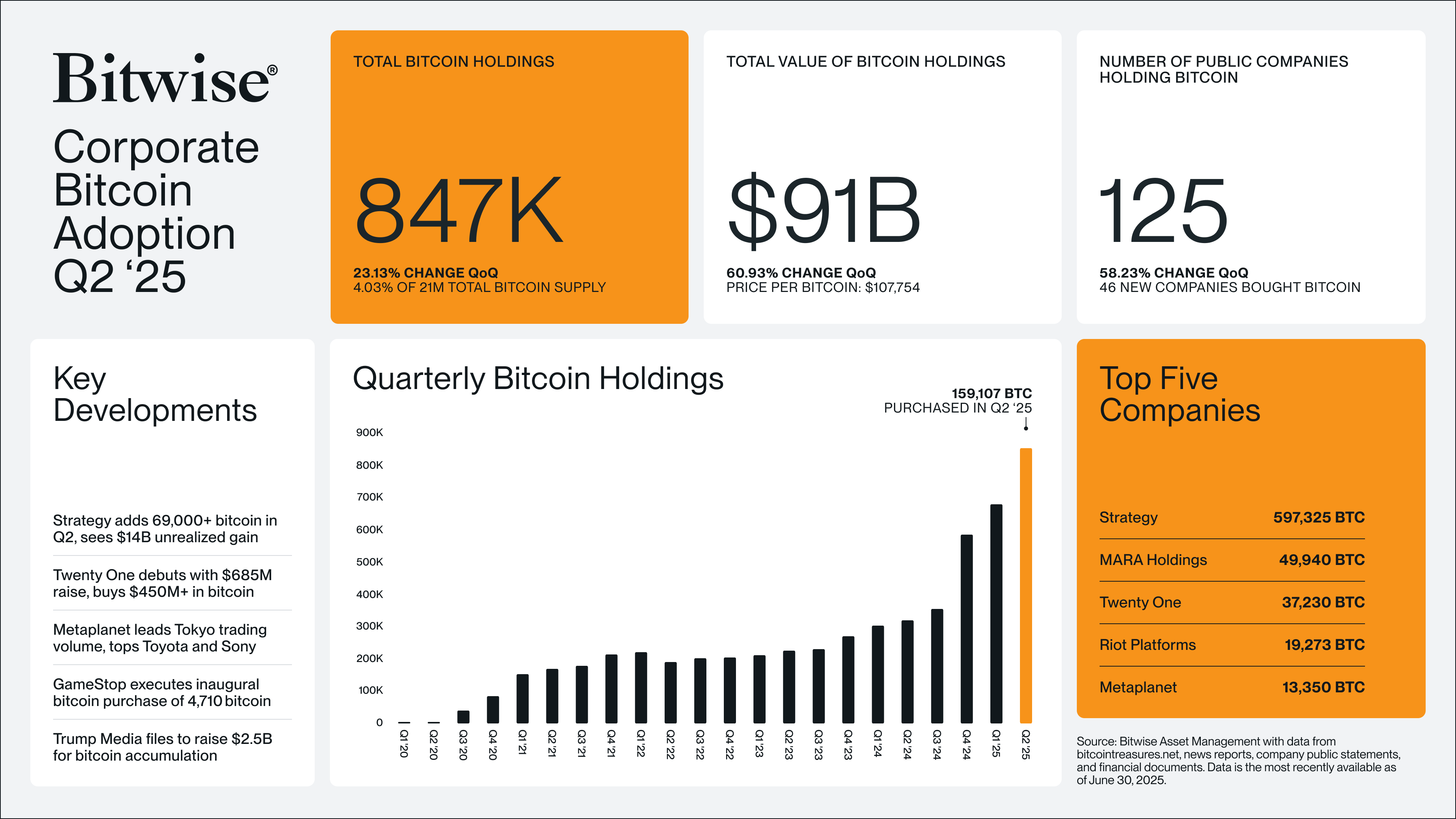

Corporate interest in Bitcoin reached new highs in the second quarter of 2025, with companies adding a record 159,107 BTC to their balance sheets, worth over $17.6 billion at current prices.

The figure marked a 23.13% quarter-on-quarter increase, bringing total corporate Bitcoin holdings to 847,000 BTC, or about 4% of the capped 21 million supply,accordingto data accumulated by Bitwise Asset Management.

The total value of corporate Bitcoin holdings surged to $91 billion by the end of Q2, calculated based on Bitcoin’s closing price of $107,754, a 60.93% price increase from the previous quarter. Since then, BTC has resumed its rally, surging to a new all-time high above $112,000 on Wednesday.

The number of public companies holding Bitcoin also jumped sharply, with 46 new firms entering the space, raising the total to 125, a 58.23% increase quarter-on-quarter.

Saylor’s Strategy leads the charge

Leading the charge is Strategy, with a massive BTC stash of 597,325 coins. The firm, led by Bitcoin bull Michael Saylor, has championed the Bitcoin accumulation strategy by consistently issuing convertible notes and at-the-market (ATM) equity offerings to fund aggressive Bitcoin purchases.

Strategy’s Bitcoin accumulation has also fueled a strong performance in its stock price. The company’s stock is up 43% year-to-date, far outperforming the S&P 500’s modest 6.4% gain over the same period. It has increased by more than 6% over the past month and by around 9% over the past week, according to data from Google Finance.

Bitcoin miner MARA Holdings is the second-largest corporate holder of Bitcoin, with 49,940 BTC. The company’s shares have gained more than 10% YTD.

New entrants are also making waves in the Bitcoin treasury space. Twenty One launched with a $685 million capital raise and quickly deployed over $450 million into Bitcoin. In Japan, Metaplanet has emerged as a powerhouse, dominating Tokyo’s trading volume and even surpassing household names like Toyota and Sony, while amassing 13,350 BTC.