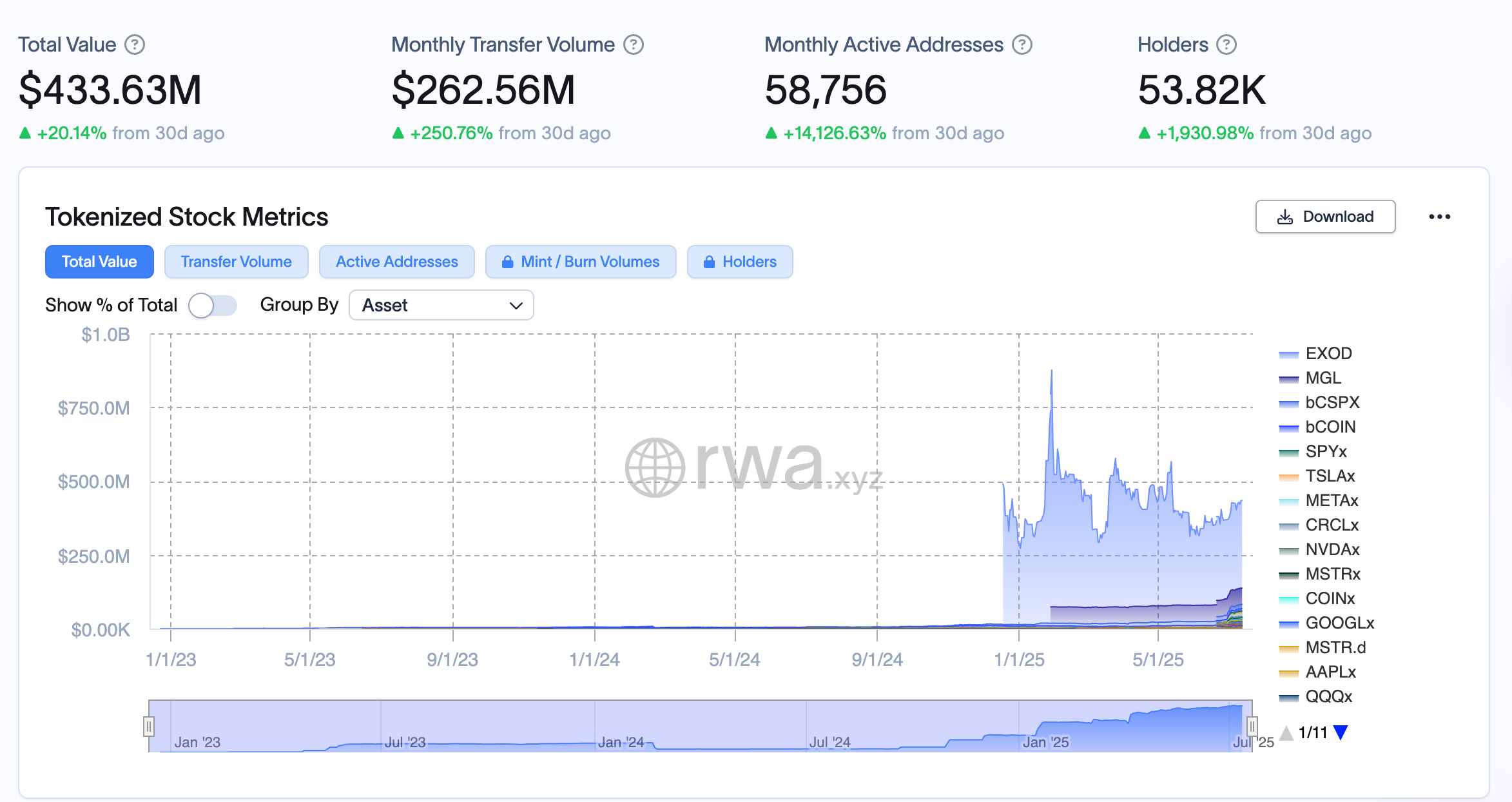

Real-world asset (RWA) tokens can democratize access to investments previously inaccessible to retail traders, similar to how exchange-traded funds (ETFs) expanded retail access to financial instruments when they debuted in 1993, according to Christopher Perkins, president and managing partner of investment firm CoinFund.

“I believe tokens are the new ETFs,” Perkins told Cointelegraph in an interview. The executive said tokenized RWAs, which trade 24/7 on globally accessible markets, reduce the information asymmetry that has typically kept retail investors out of private placements under existing accreditation laws. He added:

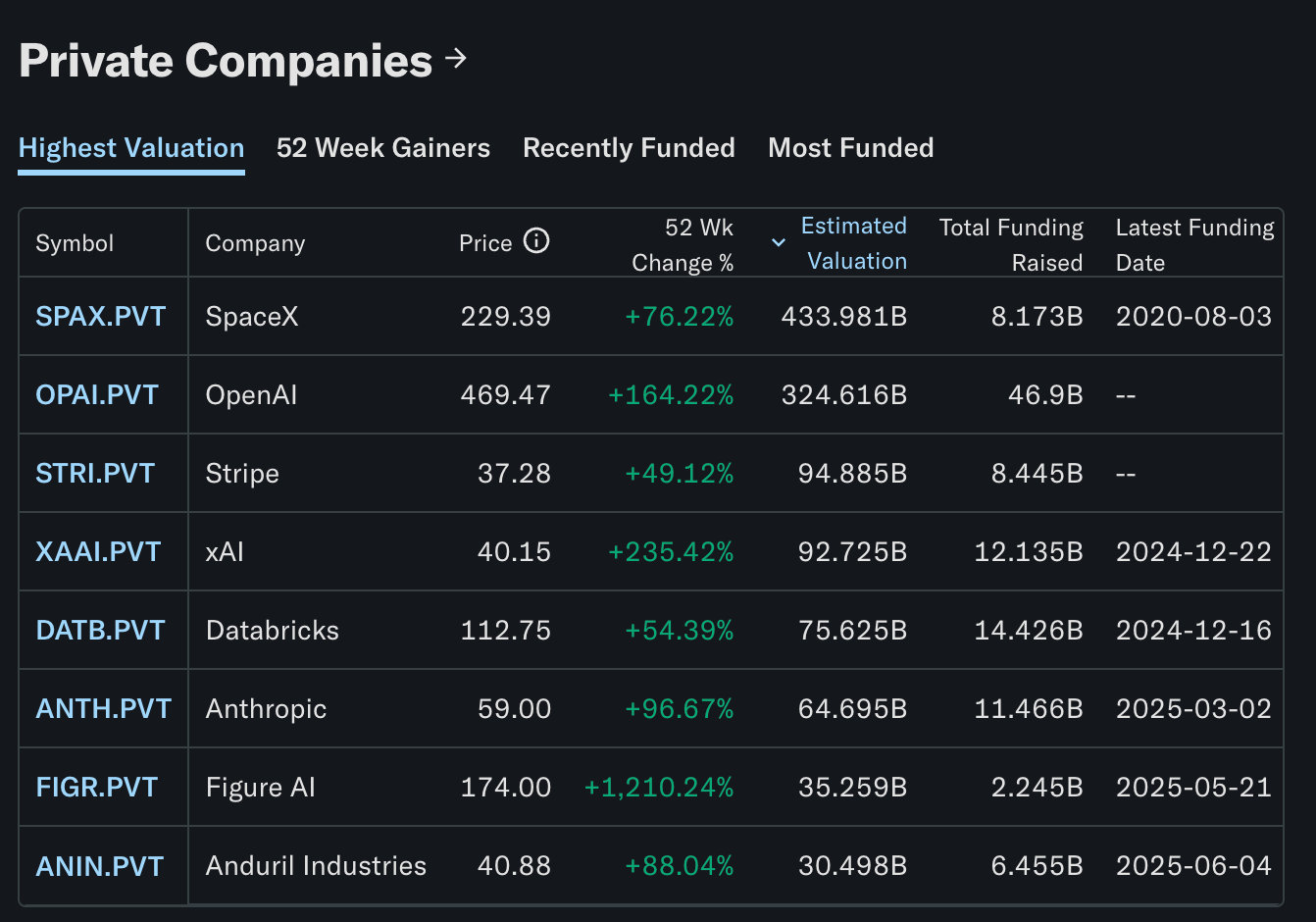

“Ordinary people cannot access private markets. They're private by their nature. And if you look in the US today, about 81% of companies — this is a BlackRock stat — with $100 million in revenue are private.

Essentially, that leaves ordinary people, normal people, very little access to what are the most exciting, the most innovative companies,” he continued.

Tokenized RWAs offer a compelling use case for blockchain technology that can increase capital velocity, enable equity financing through asset fractionalization, create new kinds of collateral for decentralized finance (DeFi) applications, overhaul current capital formation structures, and democratize investor access to global capital markets.

Public investment opportunities in TradFi drying up

“Our public markets are completely broken right now. The system is not working as it was designed. The number of public companies is decreasing materially,” Perkins told Cointelegraph.

The number of public companies has fallen by about 50% since the 1990s, according to the executive. “We are raising less money in public markets, which makes zero sense,” he added.